Phil Erlanger Research Co.

Performance Documents

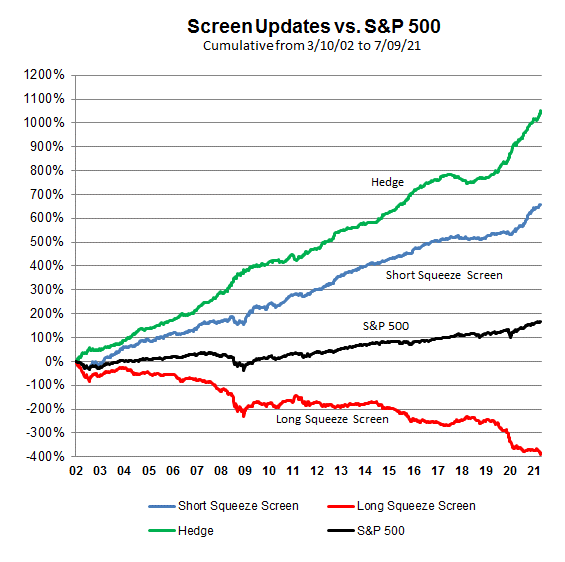

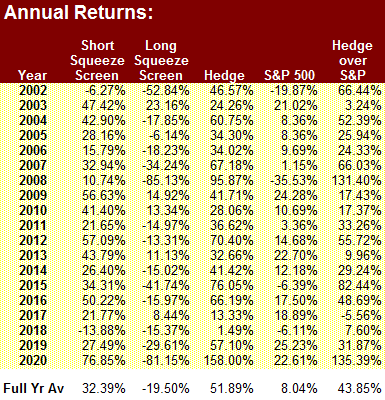

Weekly Type 1 and Type 4 Squeeze Updates

Every week we update this screen from our selected Erlanger universe of issues (these include the Dow 30 issues, S&P 100 issues, NASDAQ 100 issues and more). This screen mines for those issues that our data uncovers as "short squeeze" and "long squeeze" candidates. We find "short squeezes" as attractive because the price action is relatively strong with high short selling, or the presence of dumb short sellers. We find "long squeezes" as unattractive because the price action is relatively weak despite little short selling, or the presence of smart short sellers.

Enhanced Types

Since 1992, Phil Erlanger Research, Inc. has produced the Type Classifications. There are four Type Classifications within our traditional Type Classifications or what we will now refer to as the Relative Strength Types: Short Squeezes, Shorts Recognized Strength becomes Too Many Believers, Shorts Correct become Too Many Skeptics, and Long Squeeze. Recently, we have added what we call the Enhanced Type Classifications. There are two new categories of Type Classifications. They are Enhanced Types: Trend Types and Value Types.

With this new work, there are a variety of Enhanced Type Reports that can be found in your custom scans. Key to this process is reviewing on a daily basis to watch for subtle shifts that alert us to the beginning or end of sector rotation.

Model Portfolios

Model Portfolios are produced on a weekly basis. It is long and short ideas that are concentrated in a sector or etf. Idea generation comes from the base of Phil Erlanger's work on short interest, options, seasonality, and proprietary technical idicators. The performance numbers below are through July 2, 2021